Tax the Rich part 2

The plutocratic world class may not be worried about protecting genuine popular government, however even they rely upon having a working economy from which to benefit. That will before long become inconceivable except if move is made to reallocate a lot of abundance. The created world seems, by all accounts, to be experiencing a disquietude known as common stagnation, or languid long haul monetary development. More or less, an excess of cash is being saved, and insufficient is being put resources into useful exercises to drive maintainable monetary development.

Essentials show why. The recipe MV=PQ is known as the condition of trade. The economy's stockpile of cash (M) duplicated by the speed at which that cash changes hands (V) represents all the cash spent on buys. The value level (P) increased by the amount, everything being equal, and administrations executed (Q) represents the all out worth, all things considered. Since, by definition, buys should approach deals, the condition is consistently in balance. Q is equivalent to GDP.

Individuals in most develop western economies are living longer than they used to. In the mean time, rates of birth in these spots are declining as individuals wed further down the road and families have less youngsters by and large. The workforce as a portion of the populace won't develop over the course of the following twenty years, which means less interest in money to prepare that contracting pool of laborers. Simultaneously, where Blockbuster once recruited individuals to fabricate its physical stores and stock its racks, Netflix currently offers similar types of assistance with undeniably less unmistakable overhead; the new advanced economy has decreased generally venture. Regardless of whether these patterns are adding to a monetary quandary, however, there's no motivation to travel back in time.

The contrary side of the record is an alternate story. The condition of trade shows gigantic abundance imbalance is mostly answerable for the investment funds excess that is impeding development. Not at all like the overbearing social designing or neo-Luddism that would be needed to cure the speculation issues, lessening uniqueness in the public arena is both alluring and attainable.

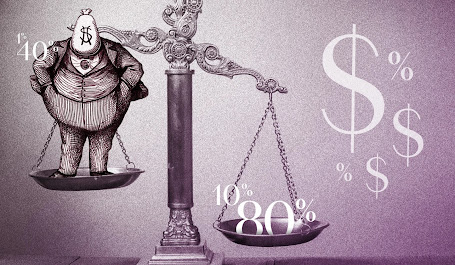

Almost 50% of all Americans and Canadians live paycheque to paycheque. These "working poor" are compelled to burn through the entirety of their extra cash and save none, so the speed of their cash is high. Rich individuals, on the other hand, have more cash than they realize how to manage. Subsequent to meeting their essential requirements, and going through some cash on extravagances, they save a critical segment of their abundance in resources (so the general speed of their cash is low). Since the most extravagant 100th of Americans possesses 40% of the nation's abundance, and the most extravagant 10th claims almost 80% (Figure 1), an immense portion of capital is saved rather than spent.

Another ramifications of abundance imbalance is obligation. At the point when an individual without reserve funds experiences a monetary crisis, they are compelled to get cash. The premium they pay on that credit is cash they would have in any case spent later on. According to the economy's perspective, at the end of the day, settling obligation is identical to saving. You'll see in our condition that assuming M and P stay consistent, a drop in V will moderate financial action, Q.

By and large, extreme reserve funds joined with lacking venture drives down the financing cost at which the stockpile of cash to acquire, and the interest for it, are in harmony. In the United States this pattern has been in power for quite a long time

An exorbitantly low loan fee is harming in various manners. At the point when the pace of return on reserve funds securities is low, financial backers heap their cash into resources offering better yields, similar to land, expanding the danger of a market bubble. Common stagnation is additionally infectious, in light of the fact that when capital escapes to search out more significant yields somewhere else, it drives down loan costs in those new spots also. To top it all off, an absolute bottom loan fee lessens strategy producers' capacity to react to emergency.

The apparently solid worth of the U.S. real estate market has for some time been utilized as insurance to guarantee a lot of subordinate monetary protections. That supposition imploded when the market failed in 2007, grabbing the mat free from a significant number of the world's biggest speculation banks whose portfolios were presented to harmful resources. Out of nowhere, nobody had the option to pay their leasers, so banks quit loaning in a particularly dangerous climate. The infection of obligation defaults ricocheted down Wall Street. The United States, and a large part of the world to which it is associated, dove into a profound downturn. It was national banks' opportunity to excel

At the point when a national bank needs to animate the economy, the customary technique is to cut the key loan cost to bring in cashless expensive to acquire. The issue is that loan fees can't be diminished on the off chance that they are as of now close to nothing. That is the circumstance wherein a few of the biggest national banks all throughout the planet, including the U.S. Central bank (the Fed), all wound up in the wake of the 2008 monetary emergency. Denied of the conventional techniques for animating their economies, they were constrained rather to go to an offbeat strategy known as Quantitative Easing (QE), an extravagant name for making new cash out of nowhere and utilizing it to buy monetary resources that nobody else needed. In doing as such, the improvement intended to resuscitate the cost of those resources and renew liquidity in the financial area to get individuals exchanging and loaning once more. In 2007, the size of the Fed's asset report was $870 billion. When it had arrived at the apogee of its QE program in 2015, the resource side of its monetary record had swelled to $4.5 trillion. The Fed had expanded the U.S. cash supply significantly.

Comments

Post a Comment